Although Eu Capital started Discretionary Portfolio Management in October 2015, our flagship mutual fund, Valence Global Fund, was only set up in May 2018 to fulfil the needs of investors who don’t need family office services.

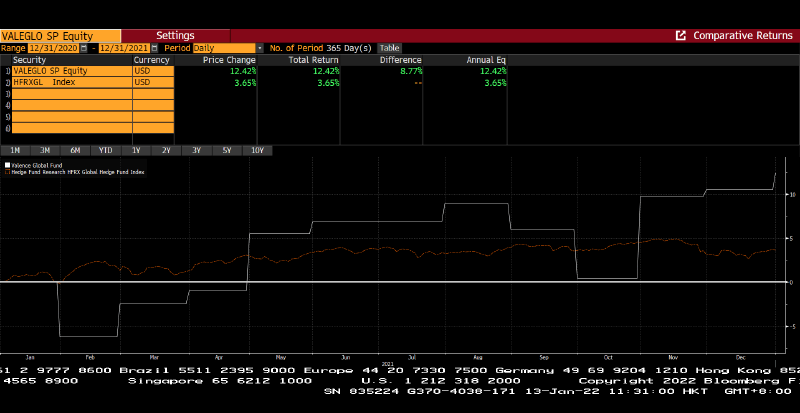

Since its launch, Valence Global Fund has returned a respectable one-year and three-year return of 12.42% and 15.01% respectively. We are proud of our outperformance compared to our peers’ returns of 4.82% and 6.95%, particularly considering the fact that we do not employ leverage or use any form of financial derivatives, and only invest in publicly-traded securities in the developed markets.

This article explains how Eu Capital has made Valence Global Fund a value-driven success story.

As per our investment strategy and objectives, we are an unconstrained global fund that aims to deliver medium- to long-term capital appreciation.

As an unconstrained fund, we are not restricted to portfolio allocation mandates. For example, many mutual funds are restricted to a maximum of 10% cash at any time. This meant we were able to sell our entire portfolio at the end of January 2020, just before the pandemic hit, then slowly buy back as economies recover.

As a global fund, we are not bound to specific geographies or industries. Instead, through bottom-up primary research, we identify the best companies in the world based on their business metrics.

Although we prefer our investors to not redeem during the first few years, we do not impose any restriction for redemption. Some funds impose a 10% maximum redemption per year, but we don’t. Our fund’s growth is organic, and redemptions are never made out of new subscriptions.

Risk management is our cornerstone. We manage the portfolio risk by detailed research, flexible portfolio allocation, and not having a target return every calendar year. For example, some managers promise to return 20% every calendar year. In such cases, if a fund’s return is only at 5% in October, its manager may feel compelled to take intolerable high risks to reach the target. We don’t do that. We believe that if we manage the risks well, the returns will take care of themselves.

Last but not least, our skin is in the game. Our managers’ majority wealth is invested in Valence Global Fund too. And the only fee that we charge is outperformance. Warren Buffet has said himself that if we make a dumb decision, we feel the same pain as our investors, only in proportion difference. Hence, we continually align our interests with our investors.

Our managers, Stanley Teoh and Kelvin Eu, have decades of experience in the financial markets dating back to the Asian Financial Crisis in 1998. They have also studied the economic impact of historical events like the 1918 Spanish flu pandemic and the Great Depression. Their knowledge and financial acumen have proven invaluable in times of market volatility and panic.

Going into 2022, we are optimistic yet cautious. We are confident of the future, regardless of market sentiment, given our deep insights and a solid understanding of our underlying businesses. Most reassuring of all, we have a proven system of investing where the only judge is time, and those that boarded our ship early reap the most benefits.